unified estate tax credit 2019

The estate tax is part of the federal unified gift and estate tax in the United States. You can also avoid the estate tax by gifting small amounts each year to your heirs.

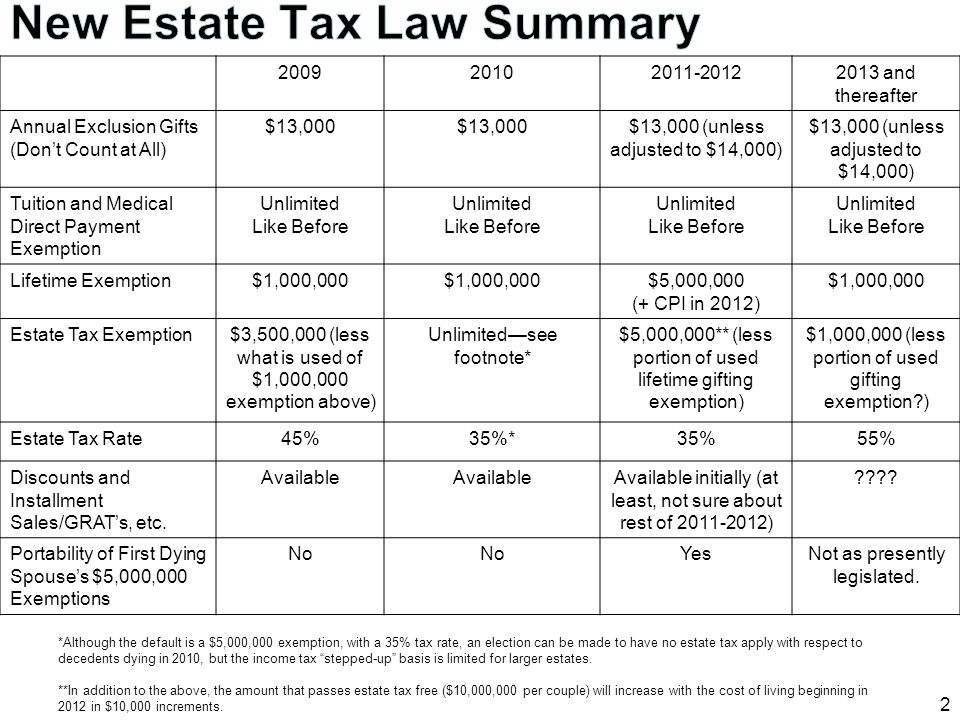

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Now when i open my UAN account I would see present employer details where they created new PF account under same UAN number.

. Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. 15000 per person per person. 2014 and before April 15 2015.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. Adds the definition of federal basic exclusion amount to both the Estate Tax Chapter 217 and the Gift Tax Chapter 228c.

Generally fiscal domicile under such treaties is defined by reference to domicile as opposed to tax residence. Annual Exclusion for Gifts. The tax is then reduced by the available unified credit.

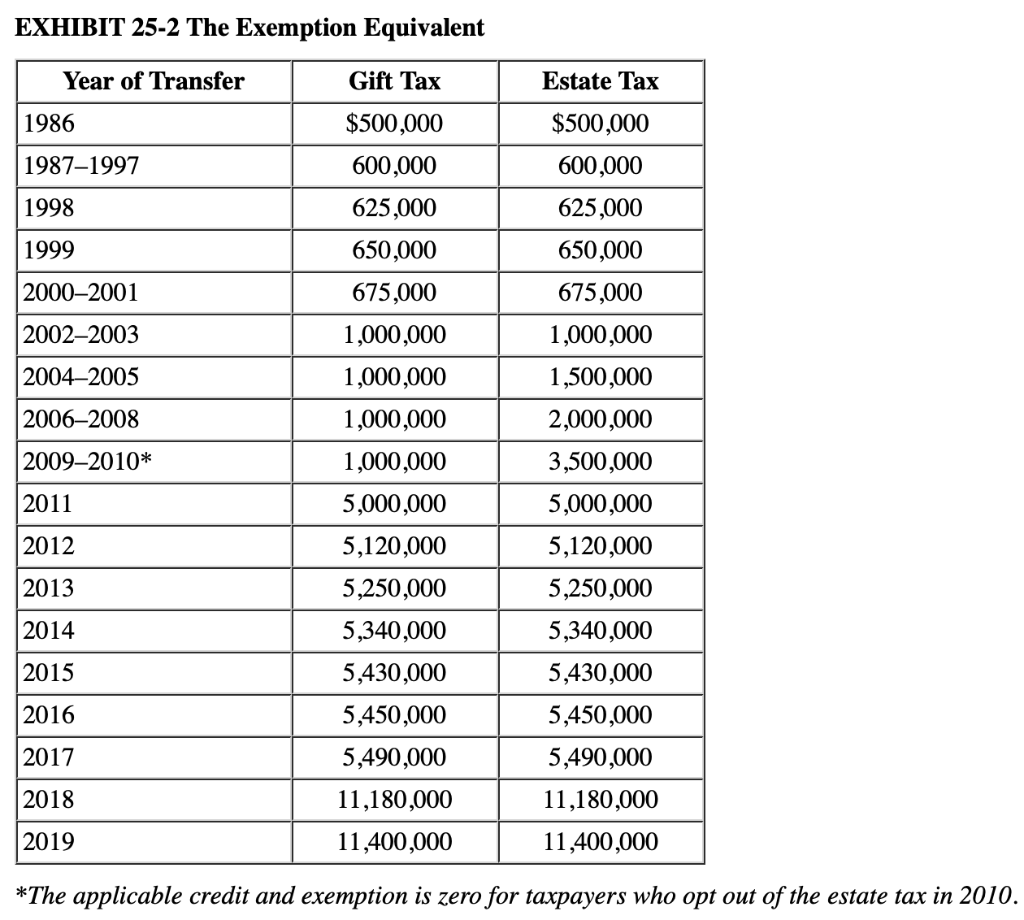

The federal Economic Growth and Tax Relief Reconciliation Act of 2001 EGTRRA of 2001 began phasing. The results of a recent district survey show that there is still strong support in the community for maintaining Polks name on the school even though the trustees shot. 2019 and ending prior to July 1 2022.

The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. Such treaties specify what persons and property are subject to tax by each country upon transfer of the property by inheritance or gift. Any tax due is determined after applying a credit based on an applicable exclusion amount.

But in June 2019 the Department of Treasury and the IRS issued final regulations curtailing the practice. Unified Estate and Gift Tax. The exemption continued to increase annually until it matched the federal estate tax exemption in 2019.

The current exemption doubled under the Tax Cuts. The unified credit is equal to The amount that can be excluded for decedents dying on or after January 1 2019 is 50 million. The Estate Tax is a tax on your right to transfer property at your death.

BO tax credit for property tax paid by an aluminum smelter. Oregons estate tax rates changed on January 1 2012 so that estates valued between 1 million and 2. Credit for real estate conveyance tax paid.

Is added to this number and the tax is computed. But I couldt see my previous employer details and transfer option too. These changes conform the Estate and Gift Tax provisions with the thresholds.

Individuals who are concerned their wealth may surpass any future unified tax credit should consider additional estate planning strategies to lock in the 117 million exemption. You can also avoid the estate tax by gifting small amounts each year to your heirs. Annual Exclusion for Gifts.

A key component of this exclusion is the basic exclusion amount BEA. Estate Planning Strategies For Reducing Estate Taxes. 2019 114 million 40 2020 1158 million 40 2021 117 million.

A person must pay the tax and may then take a credit equal to the property tax paid. The estate tax exemption is 117 million in. Section 80D 80DD and 80DDB and 80U of the act provide tax benefits Here are rules you must know to claim tax benefits under the Income-tax act provided you opt for old tax regime in current financial year.

As part of Bidens 19 trillion COVID-19 rescue package last year the existing child tax credit program was massively reshaped boosting the amount of the payments greatly expanding the pool. To the extent that any credit remains at death it is applied against the estate tax. The gift tax and the estate tax share the same exemption often referred to as the unified tax credit.

The credit is first applied against the gift tax as taxable gifts are made. It also served to reunify the estate tax credit aka exemption equivalent with the federal gift tax credit aka exemption equivalent. The Gift Tax Annual Exclusion remained the same between 2019 and 2020.

Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. The Maryland Estate Tax-Unified Credit Act altered the unified credit used for determining the amount that can be excluded for Maryland estate tax purposes. I recently joined to my new company on 28th Jan 2019 and my last working day in previous company was 25th Jan 2019.

739 the Maryland Estate TaxUnified Credit was signed into law on May 15 2014. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax. The Maryland estate tax is equal to the maximum allowable credit for state death taxes under 2011 of the Internal Revenue Code without reduction by any Act of Congress enacted on or after January 1 2001 minus the inheritance tax paid to the Office of the Register of Wills.

Inheritance tax treaties often cover estate and gift taxes. The other part of the system. The gift and estate tax exemptions typically enable wealth to be passed on from one generation to the next tax-free.

Central Unifieds School Board will once again try to bridge the community divide over the renaming of the neighborhood school formerly known as James K. For more information see the General Information section and the instructions for lines 13 and 26 on Form ET-706-I and also TSB-M-19-1E. Annual Tax Performance Report must be filed by May 31st of the following year.

15000 per person per person. The Gift Tax Annual Exclusion remained the same between 2018 and 2019. Medical expenditures for certain specified diseases provide tax benefits under the Income-tax Act.

Electronic filing of all documents required.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

History Of The Unified Tax Credit Apple Growth Partners

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Solved Roland Had A Taxable Estate Of 15 5 Million When He Chegg Com

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Msu Extension Montana State University

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

A Guide To Estate Taxes Mass Gov

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How To Advise Your Clients Under The New Estate Tax Law Ppt Download